will salt deduction be eliminated

During initial talks about tax reform the SALT deduction was almost eliminated. Response 1 of 18.

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory.

. Both the House and Senate are prepared to eliminate some or all of the SALT deduction to make up for revenue losses resulting from proposed cuts to the corporate. If you only do that youll increase cross subsidization. The House controlled by Democrats voted largely along party lines to remove the 10000 cap on state and local tax SALT deductions for tax.

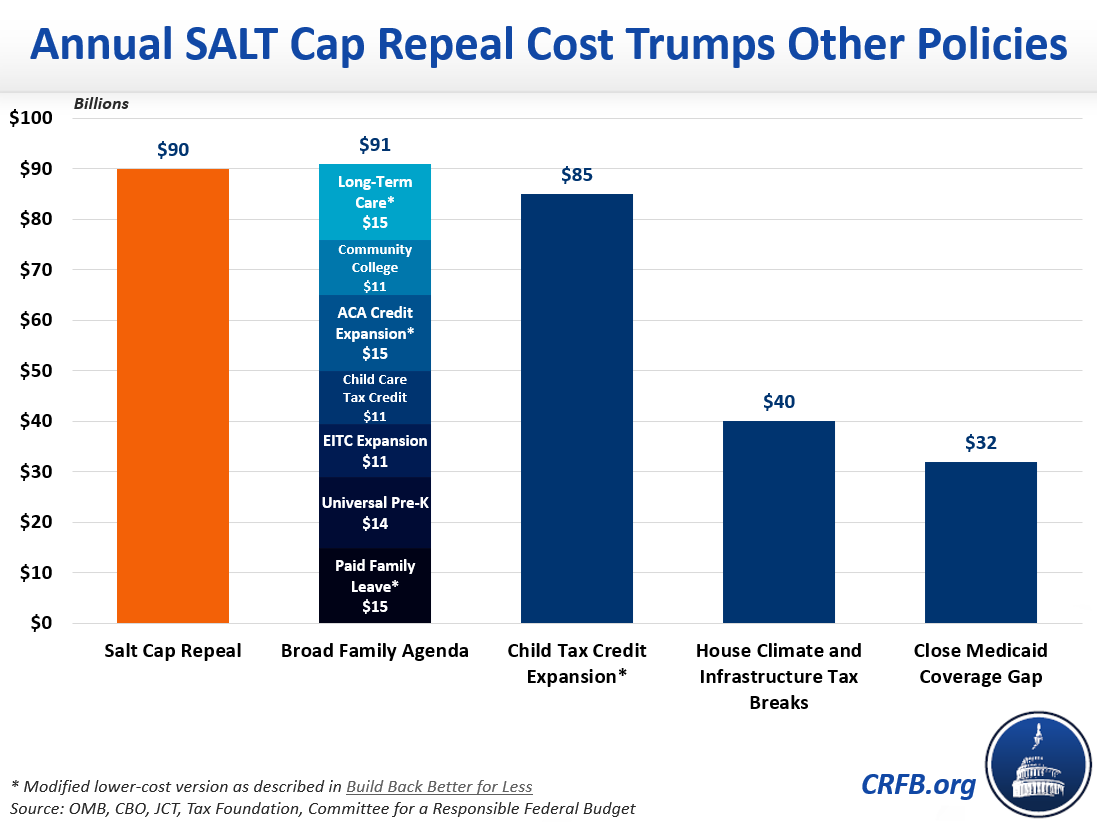

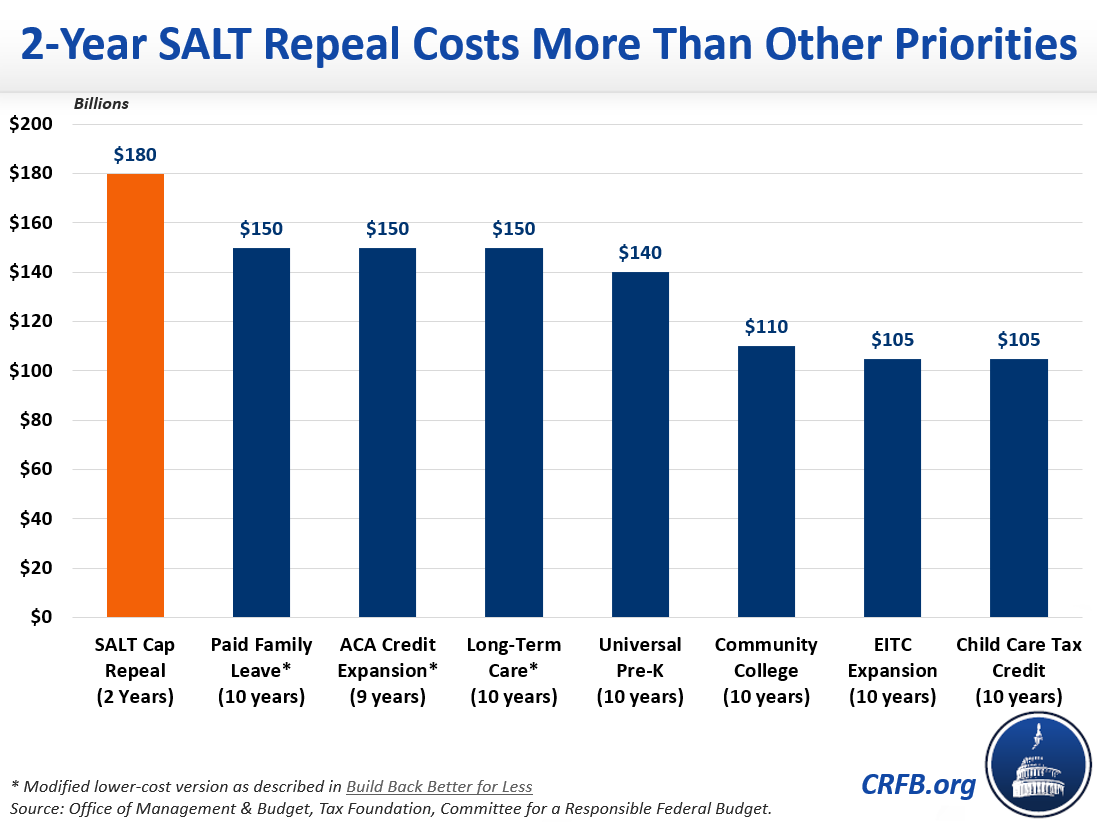

Senate Minority Leader Charles Schumer D-NY on Tuesday pushed for the cap on the state and local tax SALT deduction to be undone in the next coronavirus relief. The topic goes beyond simple politics. Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government.

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to. Herein will salt deduction be eliminated. The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis.

As a result of this legislation the SALT deduction has been reduced. No SALT no deal they said. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. After legislators realized the impact of. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

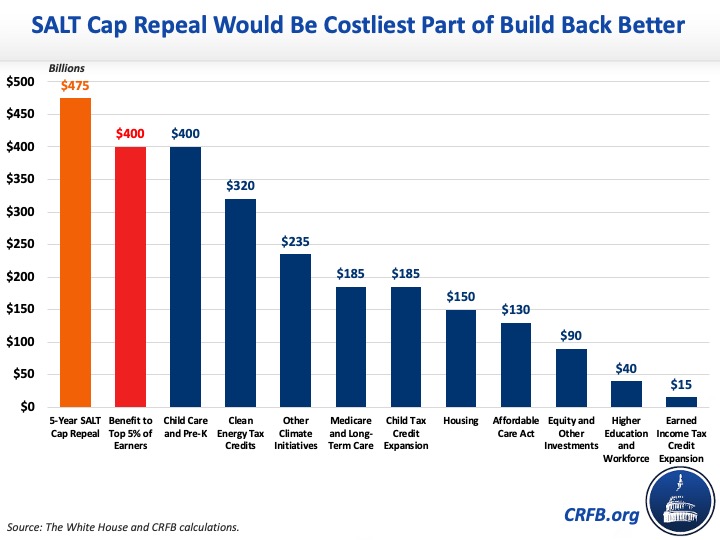

If you want to get rid of cross subsidizing states youll have to go a lot farther than that. A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion.

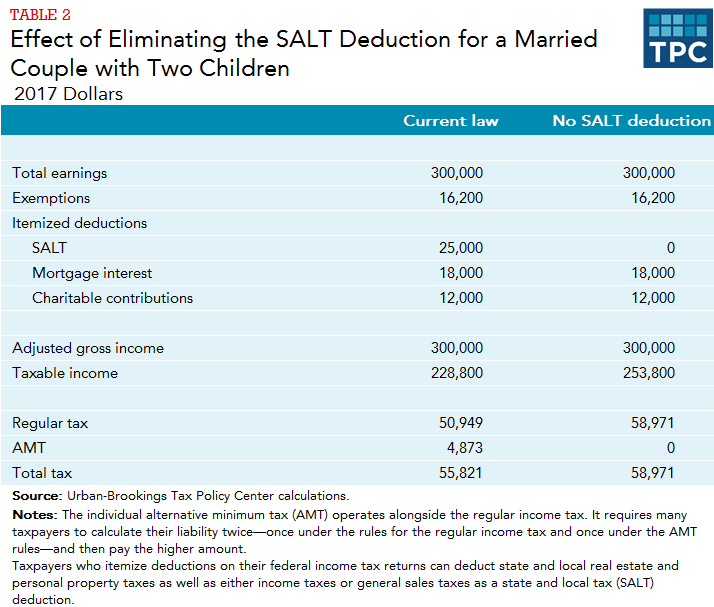

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

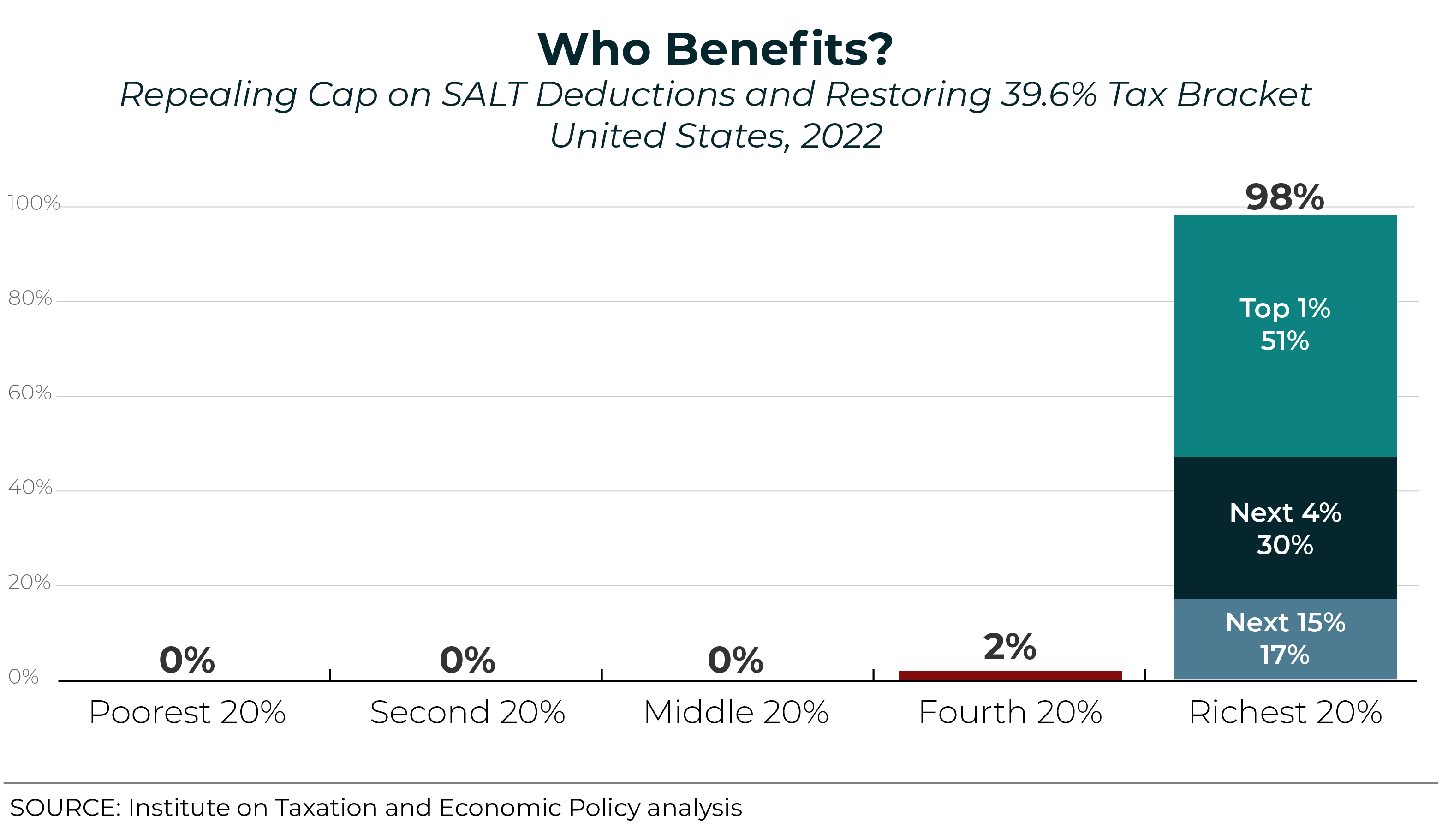

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

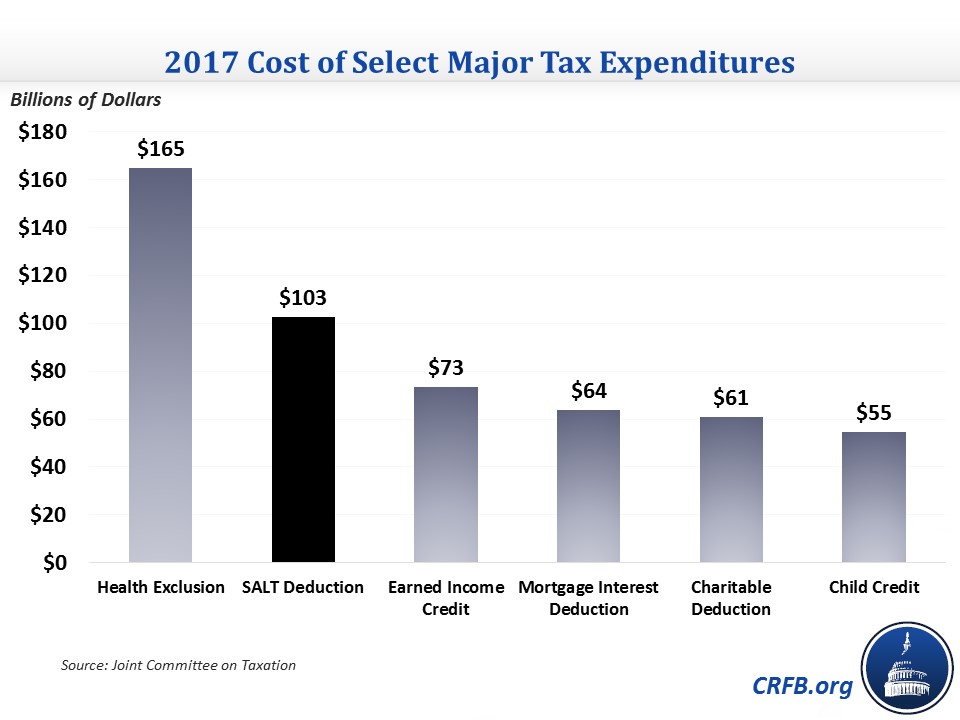

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)